In the beginning, the lab created the benzene and the reaction.And the chemistry was without structure, and ambiguous; and uncertainty was upon the face of the compounds. And the Spirit of Science moved upon the face of the solutions.And the chemist said, Let there be benzodiazepines: and there were benzos.

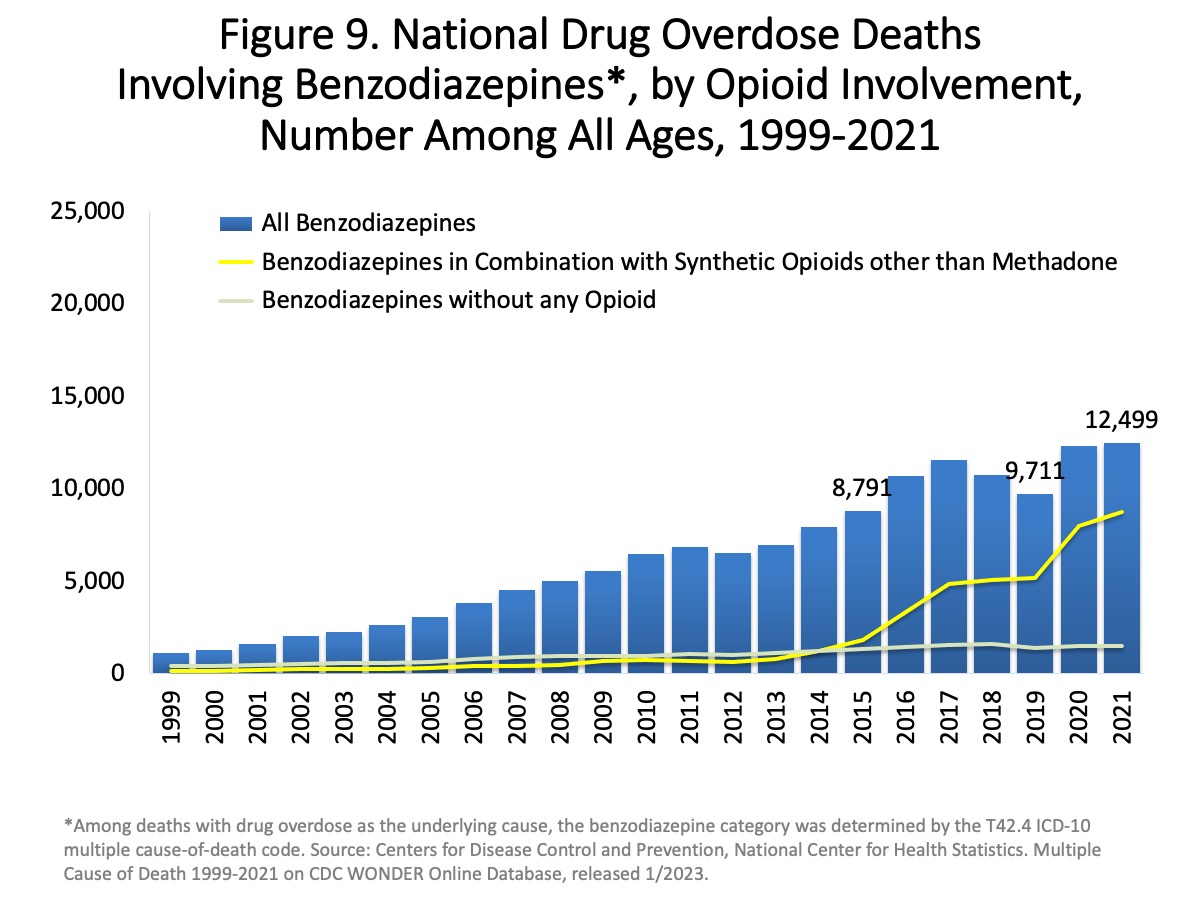

In the second half of the 20th century, benzodiazepines were the gold standard of pharmacololgical anxiety treatment– and prescriptions were given out like candy by doctors to pretty much anyone who wanted them. At one point in the late 70s, diazepam/Valium held the title of the best selling drug in all of America (many thanks to the Sackler family!)

This was not exactly a good thing; while at first seemingly appearing to be a miracle drug for all the worryworts and overwhelmed homemakers, they did not come without their side effects. Although notably less severe in side effects than their predecessor, the barbiturates – clinicians began noticing that when patients tried to get off of these things, many experienced horrible withdrawal symptoms: intense rebound anxiety, inner restlessness, partial seizures, and way too many others to list. And while on them, patients would report amnesia-like symptoms, excessive sedation, and even the dreaded "blacking out"– these pills were basically making people drunk!

It is no surprise then that benzos are now treated like the thing they really are– alcohol in a pill. They are Schedule IV across the United States and controlled in most developed countries in the world. After SSRIs came into the picture, they took over the scene for "first in class" anxiolytic drugs; and benzos became the last resort option offered to anxiety sufferers who have tried everything else.

Here's the rub, though: take one look at the reviews for various anxiolytic drugs on any medication website, and you can see which ones are loved and which ones are merely tolerated. SSRIs are merely tolerated, atypical anxiolytics like buspirone, hydroxyzine, and propranolol are either hated or only situationally helpful, and benzos reign supreme! It is obvious to me that what we have now just isn't cutting it for most people– take an SSRI and wait weeks for months to notice a modest effect and lose your ability to orgasm, or go for broke with Xanax and hope you don't end up dependent on it for a very long time.

It was this frustration with how limited the repertoire of safe, effective anxiolytics were that led me down a strange, anxiety drug themed rabbit hole: from mysterious substances brewed behind the iron curtain like phenibut and Selank to nocebo riddled supplements like skullcap, l-theanine and Silexan – all seemed too good to be true, or too scary to even be worth the try.

And after I had emerged from this terrible vortex of gray market pharmaceuticals and chemicals with names too hard to pronounce, I ended up in France.

***

The French, much like the Russians, have many an odd psychoactive to their name– the mysterious modafinil and the possibly-an-opioid-antidepressant tianeptine to name a few. But today I will sadly only focus on one: etifoxine.

Synthesized in Europe in the 60s, it was believed to be just another boring benzodiazepine; and a decade later, it began to be marketed in France as an anxiolytic called "Stresam." But here's the kicker– it's actually *not* a benzodiazepine at all!

You see, after it was synthesized, it was quickly shown that it was binding to GABA_A receptors; of which bind to the famously sedating neurotransmitter GABA. This is classically what benzos are known to do– they are positive allosteric modulators of the GABA_A receptors of neurons; they make it more sensitive to GABA, keeping open the chloride channels that cause neurons to be inhibited for stronger and a longer time.

There's a bit of a caveat to this, though– there are quite a few subunits of GABA_A– alpha, beta, and gamma, each with their own subtypes. When activated, they have different effects. From a great and very relevant Scott Alexander blogpost:

"Most research seems to have focused on the alpha subunits. Here is a very, very rough oversimplified list of pharmacological effects associated with each alpha subtype:

α1: Sleepiness.

α2: Anti-anxiety

α3: Anti-anxiety

α4: ???

α5: Memory? Dependence?

α6: ???"

The benzos work on the alpha subunit(s), and you can guess which they bind to most strongly. It is the binding to these that cause the Good anxiolytic effects and the Bad side effects of benzodiazepines. To learn more about these alpha subunits, I recommend looking at the rest of Scott's post on the topic.

So where does etifoxine fit into this alpha subunit puzzle? Simple: it doesn't.

|

| credit: Anxiolytics targeting GABAA receptors: Insights on etifoxine |

Etifoxine does not touch the alpha subunit! It instead binds to the beta subunit, which is practically unheard of in benzo literature– and a mitochondrial protein called TSPO??? By binding to TSPO, through a process not completely understood, etifoxine upregulates a neurosteroid called allopregnanolone... which is another positive allosteric modulator of GABA_A!?!??!

By these novel mechanisms, etifoxine generates a noticeable anxiolytic effect without nearly as many side effects as benzos have– since again, I must repeat– it doesn't bind to the alpha subunits of GABA_A. This means no sedation, no risk of dependence and abuse, no horrible withdrawal for those who want to get off it!

In study after study, it's been shown to work comparably or better than other often used anxiolytics– it's shown efficacy similar to "lesser" benzos like lorazepam in multiple (1) independent (2) studies (3), minus the characteristic sedation and amnesic side effects of these drugs. It isn't quite as effective as alprazolam (Xanax), sorry to clickbait you. But it gets pretty darn close*

*caveat being that some of the studies are funded by Biocodex, the company that markets generic brand etifoxine in France. So there's risk for some bias here.

So is etifoxine a free lunch? Not exactly– etifoxine does have some concerns related to severe liver and skin toxicity, enough to warrant the French government to examine its safety profile twice in almost the same decade to see if it still belongs on shelves. A sister medication called Alpidem was pulled from the market in France for this very reason.

Yet, these scary side effects seem rare and preventable enough that they don't command too much worry (hah, an anxiety drug causing anxiety)– in 2022 the French deemed them rare enough that they could stay on the shelves, as long as it wasn't prescribed by doctors to people with liver issues or previous evidence of hypersensitivity to etifoxine. From this it seems pretty clear to me that it's safe enough to be used by the masses; after all, we let people get ibuprofen and acetaminophen OTC even though they are far more dangerous than people think.

***

As much as I wanted to believe in etifoxine when researching it, I knew that it had a fat chance of being something more than just a promising and possibly disruptive drug left to the dustbin of the Big Pharma Machine. I could not for the life of me find any data of how strong etifoxine consumption was in France, which made me discouraged and almost abandon this research. But I was pleasantly surprised to learn that I was wrong in this assumption– it just took a little bit more digging.

It turns out the French are more of a fun bunch than I thought they were. Through an free database published by their national health system, you can openly peruse historical French prescription data– like how many patients are prescribed a given drug in one year– going back to 2014. The data goes as granular as to the age, sex, and geography of the (anonymized) patients prescribed these medicines, which is honestly surprising.

After Google Translating a bunch of French and figuring out how the datasets were organized (I believe the French use a different format for .csv files, which was super annoying), I was able to track etifoxine prescriptions over the past decade, and was floored. Let the data speak for itself:

|

| source. Data compiled and graphed by me. |

|

| source. Data compiled and graphed by me. |

***

It is my opinion that Americans could really benefit from a drug like this. As I mentioned before, it feels like there is no middle ground when it comes to anxiety medication in the US. Either get an overrated, overprescribed, understated side effect inducing SSRI that you will need to take every day lest you want to get brain zaps, or jump to a benzo and risk ruining your life with addiction. Etifoxine can be a really good compromise between these two extremes, albeit with a little bit of anxiety about liver damage sprinkled in there.

Can we replicate the success of the French with etifoxine right here in the US, though? It's not out of the question, IMO!

There is a company called GABA Therapeutics (from here on out, GABA Rx) working on getting a new and improved formulation of etifoxine approved in the States. The formulation makes it last for longer, having a half life that is 82% larger than the original. It looks promising– they successfully completed their phase 1 studies in January, and are expecting to start phase 2 trials for anxiety patients soon.

The question of etifoxine's success balances on if 1) GABA Rx (or rather, its parent company Atai Life Sciences) can stay afloat for long enough to see etifoxine through to market and 2) if there is enough of an appetite by patients and doctors for wanting etifoxine.

Let's give our best shot at answering both of these questions: whether Atai is a risky investment and if Americans like etifoxine as much as the French do.

Atai Life Sciences

In the beginning of 2022, Atai had ~$325 million of cash on hand; by the end, they had ~$190 million.The difference (the amount of cash they lost) is ~$170 million. $170 million / 12 = ~$14 million cash burned per month. $190 million / $14 million = 13.5 months left of cash to burn without any revenue or funding.

Atai's plan for addressing this is the following loan agreement with Hercules Capital:

source (page 156)

Put simply:

- In August 2022, the Company got a loan agreement with Hercules Capital, Inc.

- The total potential loan amount is up to $175 million, but it's split into multiple parts (or tranches).

- Here's how the loan parts break down:

- $15 million was received immediately.

- Up to $20 million can be taken out by May 1, 2023.

- Up to $25 million can be accessed between the end of the above period and December 15, 2023.

- An additional $15 million is available if certain goals are met by June 30, 2024.

- Lastly, up to $100 million can be borrowed, subject to lender approval, by March 31, 2025.

- The loan matures on August 1, 2026, but can be extended to February 1, 2027 if conditions are met.

- The interest rate for this loan is the higher of:

- The prime rate + 4.55%

- 8.55%

- The Company only needs to pay the interest for the first 30 months.

- After this period, they start repaying the loan principal in monthly installments.

- There are conditions, like having a specific amount of cash on hand and other requirements.

As of March 2023, they have borrowed ~$14 million of the $20 million they're allowed to allocate before May 2023, according to their latest quarterly report. This shows that they're being prudent– trying to borrow only what they need of the loan (they'll also be paying less in interest payments than if they took the full amount).

With the current cash burn rate and without additional revenues or changes in expenses, the $15 million they've borrowed extends their runway to a little over a year. The loan's terms, specifically the interest-only payments for the first 30 months, allow the company to manage its cash flow more flexibly in the near term at the very least.

The potential to access up to $175 million gives them additional financial flexibility if their cash burn rate increases or if they need significant capital for growth or other investments. However, the loan also comes with obligations– such as those covenants that require maintaining specific cash levels and potential penalties for early repayment. These can limit the company's financial flexibility long term in some ways.

- $1.8 million (common stock, November 2020)

- $5.5 million (preferred stock, August 2019)

- $5.0 million (preferred stock, April 2021)

- $5.0 million (preferred stock, May 2021)

- $0.6 million (preferred stock, September 2022)

- Total Investment = $17.9 million

This gives an average monthly burn rate of:Monthly Burn Rate = Cash Burn for 3 months / 3

$1 million / 3 months = ~$.333 million spent per month

Using this, the estimated runway in months is:Runway (months) = Total Investment / Monthly Burn Rate

$17.9 million / $.333 million = ~$54 months, or 4.5 years.

From what we can see of GABA Rx, this is good news!

In March 2023 Atai wrote down GABA Rx's common stock down as 0– this sounds scary, and it kind of is; that means the company is currently "worthless." But this could be due to a lot of things– maybe GABA Rx was spending too aggressively initially and now they have a lot of debt and need more funding, cautious accounting by Atai, or possibly a way for Atai to lower tax burden on GABA Rx. A write down does not affect the current cash on hand GABA Rx has, which means it won't affect the cash burn, which is mostly what we care about for now.

Etifoxine in the stars and stripes

|

| Xanax / alprazolam, source |

|

| Valium / diazepam, source |

|

| Klonopin / clonazepam, source |

|

| Ativan / lorazepam, source |

|

| Lexapro / escitalopram, source |

|

| Paxil / paroxetine, source |

|

| Zoloft / sertraline, source |

|

| Buspar / buspirone, source |

|

| Visatril / hydroxyzine, source |

Eyeballing it, total benzodiazepine prescriptions (Xanax, Valium, Klonopin, Ativan) have fallen by:

(-)10 million + (-)5 million + (-)5 million + (-)5 million = (-)25 million since ~2015

- GABA Rx's etifoxine rolls out in the late 2020s - early 2030s (let's settle on 2030 as a nice even number).

- -> This seems reasonable to me as they've just finished phase I trials and are seeking to start Phase II very soon. It took six years for buspirone to roll out from patent to FDA approved in the 1980s; probably a handful more years to get marketing and sales for it up and running. Just speculation: there's a small chance etifoxine may be able to be approved sooner since it's already an approved drug in Europe, but we'll ignore that possibility.

- Benzo / alternative anxiolytics reach prescription equilibrium by 2025 (negligible decline in benzo scripts, negligible incline in alternative anxiolytic scripts). There's already some apparent slowdown if you take a second look at the graphs above.

- -> Because of this, I think it's reasonable to see another ~5 million potential patients displaced from benzos to buspirone/hydroxyzine, the total displacement being ~25 million.

- Etifoxine prescriptions climb logarithmically after approval, peak in the mid 2030s, and decline logarithmically thereafter

- Unfortunately, GABA Rx's patent of their formulated etifoxine expires in 2036; after pharma companies lose their patent, it is almost guaranteed most patients gradually opt for the much cheaper generic instead...

- The average amount of times that a patient renews their etifoxine prescription is 5 times per year.

- The average of buspirone prescriptions:patients is ~6, while the average prescriptions:patients for hydroxyzine is ~4. I just took the average of these.

- The amount in a treatment course is 150 mg etifoxine, once per day, for 30 days.

- GABA Rx in their Phase I trialled 100 mg once per day and twice per day. I am just taking the average of these - this is also coincidentally the dose that Biocodex's Stresam is sold at.

- According to this website, a single course of Stresam is sold for up to $40 in South Africa. This is in line with the other quotes I've seen for grey market etifoxine on the internet, so I'm not sure how much I should trust it.

- Back to the French health data– we can estimate the retail price with the following information provided in this database's 2021 figures:

- The reimbursement base (BSE) - this is the standard or base amount on which reimbursement calculations are made. For medications, this could be the standard cost that the French govt health system is willing to reimburse, regardless of the actual retail price.

- Number of boxes delivered - hopefully self explanatory

- We can find the average cost per box by dividing the BSE by the # of boxes in a given year.

- 2021's figures give us a BSE of €7,646,325.89 and # of boxes at 1,950,399. That yields an average cost per box of €2.97, or $3.27 - which is very low. The historic average cost is €5.64 or $6.21, which is still really low. That's only 10 cents per pill - that being said, etifoxine is a generic drug in France, so this is not entirely surprising.

- A rough hand estimate of brand name:generic in terms of price is that brand names go for about 80 - 85% more than generic. $6.21 / (1 - .80) = $31.50 on the lower end, and $6.21 / (1 - .85) = $41.40 on the higher end - for a final average of $36.45. This is much closer to our South African estimate.

- Averaging the two estimates, of which I'd like to give the French price more weight - we get ( (.30) * $40 + (1.70) * $36.45 ) / 2 = $37 for Stresam

- 25 million potential patients, of which etifoxine takes somewhere between ~25% - 75% of by its peak (I will show trends with the different sensitivities of etifoxine adoption rate). This seems reasonable for adoption rates - see this study for the adoption rates of second generation antipsychotics. Plus, etifoxine in studies demonstrates superiority over buspirone (no less hydroxyzine, a glorified version of Benadryl); supporting the chance that adoption rates will be towards the higher end.

- Brand name Etifoxine prescription costing $55.50 per box.

- On average, patients fill their prescription 5 times per year.

- Sales begin in 2030– the year of its release– and logarithmically grow to its peak somewhere between 2030 and 2036, the year of it's GABA Rx's patent expiry (let's say 2033 for simplicity). From there, sales plateau until 2036, and logarithmically decline to zero from 2036 to 2039.

- For years until 2033 (growth phase):

- Adoption Fraction (growth) = (current year - 2030) ^2 / (2039 - 2030)

- This quadratic function ensures a smooth growth, reaching its maximum value of 1 by 2033.

- For years 2033 to 2035 (plateau phase):

- Adoption Fraction (plateau) = 1

- This constant function indicates full adoption.

- For years 2036 to 2039 (decline phase):

- Adoption Fraction (decline) = (2040 - current year) / ((2039 - 2036) + 1)

- This linear function ensures the adoption declines to zero by 2039.

- Yearly Revenue = Adoption Fraction for the year x Revenue per Patient per Year x Number of Patients

- Where:

- Revenue per Patient per Year = Cost per Box x Prescriptions per Year

- Cost per Box = $55.50

- Prescriptions per Year = 5

|

| Cumulative revenue AUC from 2030 to 2039. |

So on the bad end of things where only 25% of would-be buspirone/hydroxyzine patients switch over, we have $10 billion in total sales over its patent exclusivity period - not bad; and on the good end of things where that percentage climbs to 75%, we have nearly $30 billion in total sales. Holy blockbuster drug, Batman!!

Now, this isn't the profitability of etifoxine, merely the revenues. And this is contingent on etifoxine being successfully FDA approved and marketed - which is far, far, far from guaranteed to happen. And on top of that, we have to figure out how much money GABA Rx is expecteing to shovel in to this hypothetical success story: manufacturing costs, marketing/sales costs + administration, continued R&D costs, running large clinical trials - just to name a few important ones.

Let's try to break down each of these costs, one by one. We're going to be a bit simplistic and calculate some of these costs as fixed to the gross expected revenue of GABA Rx over the next 15 years - this is not going to be entirely clean math.

Manufacturing

Given that we were able to calculate the cost of retail price etifoxine from generic price etifoxine with reasonable-ish guessing, calculating the raw product price of etifoxine will have us work backwards in the opposite direction from generic.

The price of generic etifoxine was $3.27, if you remember - or $0.05 per pill since 60 pills are in one course of Stresam.

If we reverse engineer the formula from this paper (figure 1) which estimates raw production costs of drugs (simply divide the generic price by the multiplication factor to yield the cost of the raw product)

That would put our raw price per pill at $0.05 / 1.127 = $0.044 for generic Stresam etifoxine.

Note: this is the cost of manufacturing in India, which is pretty common in the pharma industry, so we'll keep the "multiplication factor" the paper uses.

Let's assume that the manufacture of deuterated etifoxine (GABA Rx's etifoxine formulation) is 50% more expensive per pill for... reasons. 1.5 * $0.044 = $0.066 per raw GABA Rx pill product.

At cumulative revenues of $30, $20, and $10 billion AUC:

$30 billion / $55.50 per course * 30 pills per course = ~16.2 billion pills sold

$20 billion / $55.50 per course * 30 pills per course = ~10.8 billion pills sold

$20 billion / $55.50 per course * 30 pills per course = ~5.4 billion pills sold

At a cost of $0.066 per pill, pill manufacturing costs would be:

16.2 billion pills * $0.066 = ~$1 billion on the high end

10.8 billion pills * $0.066 = ~$713 million in the middle

5.4 billion pills * $0.066 = ~$355 million on the low end

Of course, these figures assume supply perfectly tracks demand for etifoxine, as they were directly reverse engineered from the potential revenues of etifoxine.

Let's suppose that GABA Rx was roughly 80% efficient at tracking etifoxine supply to demand with zero friction in needless manufacturing. That would mean that they are 20% inefficient - they produce 20% more pills than needed over the lifetime of etifoxine sales.

1.2 * $1 billion = $1.2 billion on the high end, cumulative

1.2 * $713 million = $855 million in the middle, cumulative

1.2 * $355 million = $426 million on the low end, cumulative

Marketing / Sales and Administration

According to this resource, "big" biotechs (>$250 million revenue) will tend to spend 10% of their revenue on advertising and marketing alone. As GABA Rx is expected to more than achieve this kind of revenue by the next decade if their etifoxine is approved, this sounds reasonable.

Derek Lowe analyzed SG&A costs as a percentage of pharma revenue ten years ago, and cites an illustration from a consulting firm which claims 20 - 35% of biotech revenues are spent on SG&A. Let's settle for a clean 27.5%.

.275 * $30 billion = $8.25 billion cumulative on the high end

.275 * $20 billion = $5.5 billion cumulative in the middle

.275 * $10 billion = $2.75 billion cumulative on the low end

R&D

Conveniently, Derek shows the R&D percentages of pharma revenue in that same blogpost. They vary a decent amount per company, but roughly hover around ~20%.

This statistic backs that claim up.

.20 * $30 billion = $6 billion cumulative on the high end

.20 * $20 billion = $4 billion cumulative in the middle

.20 * $10 billion = $2 billion cumulative on the low end

This assumes GABA Rx spends the same % of revenue on R&D after etifoxine is finished in development, which may not exactly be the case.

Clinical trials

Depending on the phase, clinical trials can cost anywhere from $50 to $300 million each. For the sake of simplicity, we'll round the entirety of clinical trial spending to $500 million, cumulative.

Other costs

There will be other costs involved too with running a biotech company - like salaries, equipment, regulatory compliance, and rental space. We'll assume these take up 15% of revenue.

.15 * $30 billion = $4.5 billion cumulative on the high end

.15 * $20 billion = $3 billion cumulative in the middle

.15 * $10 billion = $1.5 billion cumulative on the low end

Given this information, we can finally estimate the value of GABA Rx!

Best case scenario (75% market penetration):

$30 bn revenue - $1.2 bn (manufacturing) - $8.25 bn (SG&A) - $6 bn (R&D) - $0.5 bn (clinical trials) - $4.5 bn (other) = ~$9.5 billion in gross profit

Middle case scenario (50% market penetration):

$20 bn revenue - $0.855 bn (manufacturing) - $5.5 bn (SG&A) - $4 bn (R&D) - $0.5 bn (clinical trials) - $3 bn (other) = ~$6 billion in gross profit

Worst case scenario (25% market penetration):

$10 bn revenue - $0.426 bn (manufacturing) - $2.75 bn (SG&A) - $2 bn (R&D) - $0.5 bn (clinical trials) - $1.5 bn (other) = ~$3 billion in gross profit

Discounting these cash flows with a WACC of ~10% (the rough average of this, this, and this website's estimate of Atai's WACC... I'm too lazy to calculate it myself, plus GABA Rx is privately owned so we can't find their WACC), we get final expected discounted cash flows of:

High: $9.5 billion / (1 + .10)^16 = $2 billion discounted gross profit

Middle: $6 billion / (1 + .10)^16 = $1.3 billion discounted gross profit

Low: $3 billion / (1 + .10)^16 = $650 million discounted gross profit

***

It would be understandable to be skeptical of these figures - after all, I don't have a crystal ball or anything! But even taking my estimates at 30% confidence, the expected value at the very worst would be .30 * = $650 million = $195 million in "expected added value" to Atai from GABA Rx's worst case potential revenue streams alone - they have 8 other programs in the works.

Updating my priors about etifoxine since starting researching it, I expect 50% market penetration with 70% confidence, for an expected value of .70 * $1.3 bn = $900 million in value, or a 3x return investing in Atai from now until 2040, just from GABA Rx alone.

In addition, just as I was writing this post, the FDA approved a brand new GABAergic drug for postpartum depression (a first!), with a mechanism of action not all that different from etifoxine– it's a modified version of allopregnanolone, the neurosteroid that etifoxine upregulates in the brain, which is very encouraging.

This could be a very interesting investment opportunity. I welcome anyone who's skeptical to adjust my assumptions and inputs - like the patient population size, the sensitivity of adoption to etifoxine, etc :)

Conclusion

Etifoxine is a promising alternative for anxiety sufferers looking for reprieve. It's bizarre to see how it never had enough escape velocity to spread outside of France to other countries in the West, since it very well could be as effective as benzodiazepines and superior to SSRIs / alternative short acting anxiolytics without nearly as horrible side effects as any of them; it performs as well as Ativan and Valium in France. There are spurious reports of serious adverse effects, but nothing has worried the French government enough to pull it from shelves in many decades of use.

GABA Therapeutics is developoing a promising candidate for brining a version of etifoxine into the US market, and it looks like etifoxine could be a disruptive force compared to current short acting benzo alternatives like hydroxyzine and buspirone. It is because of this, in my opinion, that its parent company Atai Life Sciences could be a promising investment, yielding a multiple on return from now to 2040.

Whether or not etifoxine succeeds here in the US, I am eager to see its progress in clinical trials - it is a fascinating drug with a fascinating history and future. I certainly hope it lives up to the praise I've given it here!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.