The Day Novartis Chose Discovery

How a Swiss pharma giant built the last great corporate research skunkworks - and why that model may never work again.

In 2002, Mark Fishman walked into a glass building in Cambridge with an unusual assignment: to turn the Swiss pharmaceutical company, Novartis, into the world’s greatest therapeutics research firm. More unusually still, Fishman was - at least on paper - precisely the wrong man for the job.

The Harvard cardiologist had spent his career studying zebrafish hearts and teaching medical students. He had no pharmaceutical experience and no business training. And yet, Daniel Vasella - the physician-turned-CEO who had overseen the merger of Ciba-Geigy and Sandoz to form Novartis1 back in 1996 - had just handed Fishman billions of dollars to reignite the company’s internal drug development programs.

The timing was inauspicious. Fishman was recruited at a moment when pharmaceutical R&D productivity was halving every nine years. In the early 2000s, a dollar of research produced only a fraction of the drugs it generated in 1950. The pharmaceutical industry at large was adapting by acquiring innovative drugs rather than discovering them in-house. Pfizer was purchasing companies left and right. Merck was cutting research budgets. Even Roche, with its legendary research heritage, was turning to external partnerships. The consensus was absolute: internal R&D was finished.

But Fishman didn’t see it that way.

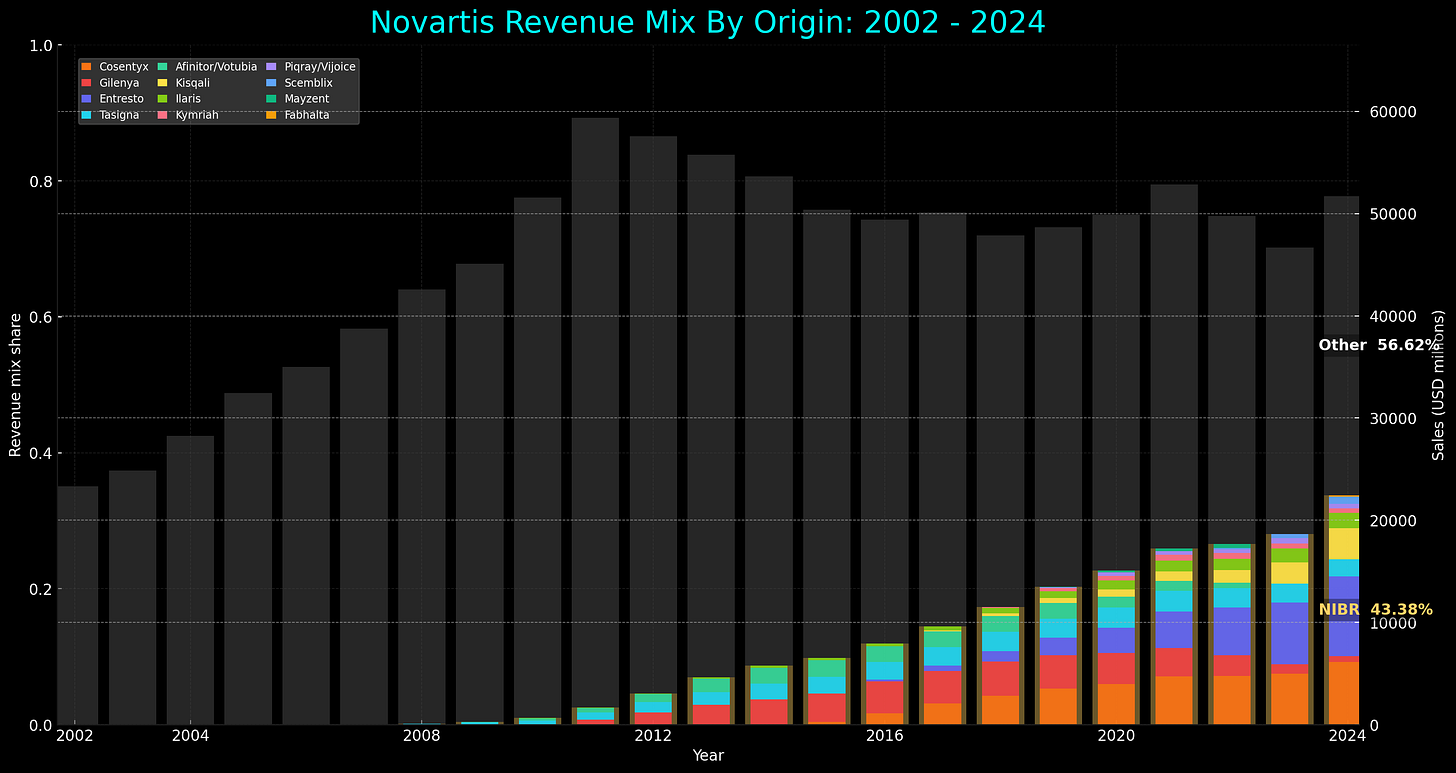

What emerged from his unlikely hire over the next fourteen years would systematically violate many principles of modern pharmaceutical management. But the Novartis Institutes for Biomedical Research (NIBR) would achieve something the pharmaceutical industry had begun to consider a fantasy: Under Fishman’s tenure, 65 percent of the company’s new drug approvals came from internal development. Many of these drugs would go on to earn the company tens of billions in revenue. And then, in 2016, Novartis began dismantling it.

This is the story of an academic cardiologist and a CEO who showed that curiosity‑driven research can rival the best work in pharma, and why even that success could not shield their institute from unforgiving market forces.

The Bronze Age Collapse of Pharma

When Daniel Vasella announced in 2001 that Novartis would create the largest corporate research organization in the industry, the timing couldn’t have been worse.

The late 1990s brought a crisis of confidence in pharmaceutical safety, effects that continued into the early 2000s. Twelve prescription drugs, or roughly 5 percent of all marketed medicines, vanished from pharmacy shelves between 1997 and 2001. Most were withdrawn due to safety concerns. The popular “fen-phen” weight-loss combo, for example, was found to damage heart valves, thus ending the first weight-loss drug craze.

Then, in September 1999, eighteen-year-old Jesse Gelsinger died during a gene therapy trial, the first person publicly identified to have died from an experimental gene treatment. His death shook regulators so much that the once-hyped gene therapy sector collapsed. The fallout continued for decades.

As bad as this was, nothing quite compared to Vioxx. When Merck withdrew their blockbuster painkiller in 2004, an estimated 20 million Americans had already taken it. But studies had linked the medication to 88,000 heart attacks and 38,000 deaths. Congressional hearings and thousands of lawsuits followed, creating what industry analysts called a “regulatory ratchet effect,” where a pharmaceutical failure leads to stricter requirements that rarely loosen later on.

These failures shifted how companies prioritized their research and development programs. Scientists became less inclined to take “courageous” bets. Risk-taking gave way to risk aversion as companies instituted extra safety checkpoints and killed higher-stakes projects earlier. Meanwhile, the industry faced what researchers dubbed the “Better than the Beatles” problem. Since most common diseases already had effective, cheap generic treatments, companies were forced to move into tougher, uncharted disease areas with inherently higher failure rates.

The industry’s response was predictable and consequential. It chose to consolidate and externalize. Rather than fix their R&D organizations, companies combined them or abandoned internal discovery altogether; instead looking toward venture-funded biotech companies to take on early research risks, with pharma running expensive later-stage Phase III trials with drug candidates that seemed likely to succeed.

This cautious approach had become standard by the time Vasella decided to hire Fishman and give him billions to pursue basic biological research in-house with minimal commercial oversight.

The Candy Factory Coup

Mark Fishman was a curious choice to lead Novartis’ R&D arm. The Harvard Medical School professor had published many elegant papers on cardiac genetics, but few people outside academia ever read them. While he had no business training, no pharmaceutical experience, and no obvious qualifications for running a multi-billion-dollar research operation, he did have genuine scientific curiosity. While industry veterans knew all the reasons why ambitious projects wouldn’t work, Fishman had no presumption they were “impossible”. His academic background meant he thought in terms of biological mechanisms rather than market segments, and to value scientific problems above profit margins.

So why Fishman, then? Vasella's choice to poach him was rooted in his own medical training. At the time, he himself was the only physician leading a major pharmaceutical company. Where business-minded executives saw the Human Genome Project's flood of new targets as a management challenge requiring cost controls, Vasella saw a once-in-a-generation scientific opportunity that demanded the opposite approach. His bet was that only an immersive, talent-first strategy could convert the genomic revolution into breakthrough medicines - a commitment that would require patient capital and faith in science over spreadsheets.

Hiring Fishman was only part of Novartis’ decision to double down on curiosity-driven science, though. In 2002, Vasella also decided to move Novartis’ global research headquarters from Basel, Switzerland, to Cambridge, Massachusetts. No European pharmaceutical giant had ever abandoned their home turf quite like this. Vasella was betting that breakthrough innovation required immersion in a richer biotech ecosystem, even if that meant severing traditional business relationships.

Fishman’s new institute occupied the old New England Confectionery Company factory in Kendall Square near MIT. Where millions of chalky wafers once rolled off production lines, 900 newly hired scientists set up their research benches. “We have to go where the talent is,” said Vasella. “Cambridge is a pool of scientific talent not found elsewhere in the world.”

From here, Vasella instructed Fishman to invent a research culture that borrowed the best from both industry and academia. NIBR would operate independently of Novartis’ marketing department, research priorities would not be dictated by sales teams, and projects would be selected on their potential to “change the practice of medicine,” regardless of commercial outlook.

When asked about research strategy, Fishman sketched out a 2x2 chart with “unmet medical need” on one axis and “mechanistic understanding” on the other. Its sweet spot lay in the upper right: Novartis would develop drugs with clear biological mechanisms for desperate patients.

“What wasn’t on the chart?” asked Fishman. “Money… we were the only group that didn’t assess projects based on market potential.”

NIBR explicitly rejected the financial reductionism of tracking efficiency metrics, calculating financial returns, and killing projects that didn’t promise huge profits. This structural foundation would prove critical as Novartis began rejecting the fundamental orthodoxies of modern pharmaceutical management.

The Four Heresies of NIBR

Four organizational principles crystallized from NIBR's culture under Fishman: approaches that flew in the face of everything the industry had learned from its disasters. Each principle - nay, heresy - addressed a specific failure mode of crisis-era pharmaceutical management. And together, they created a reproducible system for breakthrough innovation.

Heresy 1: Fast Proof-of-Concept in Extreme Phenotypes

The first was to deliver fast proof-of-concepts for extreme phenotypes.

Call it smart drug development if you must, though it functioned more like a scientific cheat code. The desperate and the rare, it turned out, are biology's most honest witnesses - and they could validate mechanisms with shocking speed.

Fishman’s approach towards canakinumab illustrates this radical philosophy. Canakinumab is an antibody that targets IL-1β, a master inflammatory switch. Rheumatoid arthritis beckoned: 1.3 million patients, established market, clear path to blockbuster status. Any pharmaceutical executive could have mapped that strategy in their sleep; and most would have.

Instead, Fishman’s team turned to Muckle-Wells syndrome, discovered in 1962 and found in only four hundred patients worldwide - what most would consider a commercial footnote. But these patients offered something priceless: a pure test of IL-1β’s importance. Their daily fevers came from a genetic mutation that continuously floods their systems with the protein. Block IL-1β here, and the antibody’s binding would be unmistakable; and so Novartis ran clinical trials, dosing patients suffering from Muckle-Wells syndrome with canakinumab.

The first patient's fever broke in a day. All patients responded with shocking immediacy - fevers that had burned daily for decades simply switched off, as if someone had finally found the thermostat in a house that had been sweltering since childhood. One dose. 24 hours. Proof-of-concept achieved.

This rapid validation became the foundation for confidently testing the same mechanism across multiple inflammatory conditions: systemic juvenile idiopathic arthritis, gout, and eventually atherosclerosis. But the ultimate validation came with CANTOS - a massive cardiovascular prevention trial enrolling 10,000 patients with prior history of cardiovascular disease. Four years into the study, Fishman got a call from up above: "This better work." It did. The combined risk of heart attack, stroke, or cardiovascular death dropped by 15%. Then came a surprise nobody had predicted: lung cancer incidence plummeted by 67%. What began as a 24-hour proof-of-concept in 400 patients had revealed fundamental inflammatory mechanisms underlying diseases affecting millions.

Heresy 2: Follow Pathways, Not Disease Categories

The second heresy followed naturally: organize around biological pathways, not market categories.

While the pharmaceutical industry had structured itself around market categories - cardiovascular, oncology, neurology - NIBR began to organize around biology itself, following the ancient molecular pathways that connect seemingly disparate diseases.

Consider the wandering history of fingolimod, or FTY720, a synthetic analog of myriocin originally isolated from the fungus Isaria sinclairii. Its mechanism is both elegant and counterintuitive. This drug interacts with lymphocytes, the immune system’s foot soldiers, and forces them to remain sequestered in the lymph nodes. The trapped lymphocytes, unable to circulate through the bloodstream, stop crossing into tissues where they might cause harm.

Fingolimod’s original indication was kidney transplantation, where the goal was to prevent organ rejection by temporarily knocking out the immune system’s surveillance apparatus. But as often happens in drug development, the results weren’t as expected. The kidney program failed, though not because the mechanism was wrong; but because transplant rejection was not the right disease to showcase lymphocyte sequestration. Transplant patients already receive powerful immunosuppressive cocktails, leaving little room for fingolimod's unique mechanism to demonstrate additional benefit.

Yet, rather than abandon the pathway entirely like most other pharmas would, NIBR made good on its second heresy by asking a completely different question: where else might wayward immune cells cause problems?

The answer came from an unexpected direction: multiple sclerosis, a disease that exists at the intersection of immunology and neurology. In patients with multiple sclerosis, T-cells cross the blood-brain barrier and attack myelin, the insulation surrounding nerve fibers. The result is progressive neurological damage as the immune system attacks the central nervous system.

If fingolimod could prevent immune cells from circulating through the bloodstream… could it prevent them from entering the brain?

As it turned out - yes. When Gilenya (fingolimod’s commercial name) was approved by the FDA in 2010, it became the first oral therapy for multiple sclerosis, transforming a failed transplant drug into a three-billion-dollar medicine. Fingolimod’s success verified that biological pathways rather than market categories should determine how pharmaceutical companies think about disease and treatment. While competitors’ research-arm design made pathway-following discoveries organizationally challenging, NIBR minimized company silos and enabled researchers to ask: “Where else does this biological mechanism cause problems?”

Heresy 3: Embrace Academics - Don't Compete

The third heresy challenged the industry's relationship with academia itself.

Most pharmaceutical companies viewed universities as potential threats or irrelevant ivory towers, maintaining arm's-length licensing relationships.

NIBR's academic culture went beyond hiring professors; it required rebuilding pharma's relationship with knowledge creation itself. While competitors guarded research behind corporate walls, NIBR encouraged scientists to publish prolifically, present at conferences, and maintain deep university collaborations.

NIBR's ability to move from biological insight to clinical validation with such confidence stemmed partly from their unusual organizational structure: the same scientists who designed the discovery program shepherded their molecules through first-in-human studies. Unlike the traditional pharmaceutical model where compounds are "thrown over the wall" from research to development, NIBR integrated translational medicine physicians into discovery teams from day one. These physician-scientists remained with their programs through early clinical trials, preserving institutional memory and ensuring that critical biological insights didn't get lost in translation. When canakinumab moved into human testing, the researchers who understood its mechanism at the molecular level were also the same ones designing clinical protocols for it.

NIBR scientists published in Nature, Cell, and Science at rates comparable to leading academic institutions. The institute’s publication record even became a recruiting tool, because it proved that joining Novartis didn’t mean abandoning scientific ambition.

This openness extended to the most unconventional research areas, such as gerontology. Most competitors avoided aging research as being too basic, too risky, and too long-term. NIBR, however, saw its potential to unlock multiple therapeutic areas. As unsexy as it is, everyone ages. Joan Mannick, a physician-scientist who joined NIBR to study immune aging, showed the institute's willingness to tackle such unconventional research areas.

This same philosophy of embracing overlooked opportunities would prove crucial in another area entirely. Carl June, an immunologist at the University of Pennsylvania, was pioneering CAR-T cell therapy - a revolutionary technique for genetically reprogramming a patient's own immune cells into cancer-killing machines. Rather than a standard license, Novartis and Penn created a deep co-development alliance and built the Novartis-Penn Center for Advanced Cellular Therapeutics on Penn’s campus, a joint facility staffed by Penn and Novartis scientists that accelerated CAR-T research and manufacturing.

The partnership that emerged was impressive in its depth and integration. June's team worked alongside NIBR scientists as they refined CAR-T manufacturing and dosing protocols, eventually leading to Kymriah, the first approved cell therapy. And when resistance mutations inevitably emerged, the academic-industry teams worked together to understand their mechanisms and develop next-generation approaches.

This deep academic integration eliminated the "valley of death" that typically exists between discovery and development. Because by keeping the scientists who understood the biology involved in clinical design, NIBR ensured that crucial insights weren't lost in translation.

Heresy 4: Don’t Build The Wheel From Scratch

NIBR’s fourth and final heresy was to refuse to be scared off by research areas already extensively investigated or tainted by previous setbacks. While competitors focused on de novo drug discovery within predictable development cycles, NIBR systematically built upon research foundations laid decades earlier.

NIBR’s long-term approach built on decades of blood pressure research. Scientists had discovered that the body controls circulation through a hormone cascade involving angiotensin, a stress hormone that constricts blood vessels and raises pressure. When ACE inhibitors - drugs that block angiotensin production - emerged in the 1980s, they helped heart failure patients, but weren’t enough. Half still died within five years.

The last major innovation attempt had been omapatrilat, which tried a promising dual approach: block an enzyme called neprilysin to boost natriuretic peptides (heart‑protective hormones that help the kidney shed salt) while simultaneously blocking the harmful angiotensin pathway. But as the drug also elevated bradykinin, a molecule that can cause life-threatening throat swelling, the FDA rejected it in 2002.

NIBR saw an opportunity in this failure. Instead of abandoning the dual approach entirely, they spent five years redesigning around it. Omapatrilat’s throat swelling problem came from how it blocked angiotensin, so NIBR paired their neprilysin inhibitor with valsartan - their already-approved blood pressure drug. This eliminated the bradykinin problem while preserving the dual benefits.

The resulting combination drug - LCZ696, later named Entresto - faced the hardest possible benchmark. It had to go head-to-head against enalapril, the gold standard ACE inhibitor. This trial, dubbed PARADIGM-HF, was stopped early because Entresto’s benefits were so overwhelming that continuing would have been unethical.

LCZ696 reduced the primary composite endpoint by 20 percent compared to enalapril. All-cause mortality dropped by 16 percent. But the timeline had been a long one. By the time Entresto was approved in July 2015, 28 years had passed from valsartan’s first synthesis. By 2024, it had grown to a $7.8 billion franchise.

While competitors started fresh with each program, NIBR’s fourth heresy compelled them to treat their entire research history as cumulative capital. They recognized that breakthrough medicines emerge by patiently and deliberately building upon decades of biological understanding.

NIBR’s Scorecard

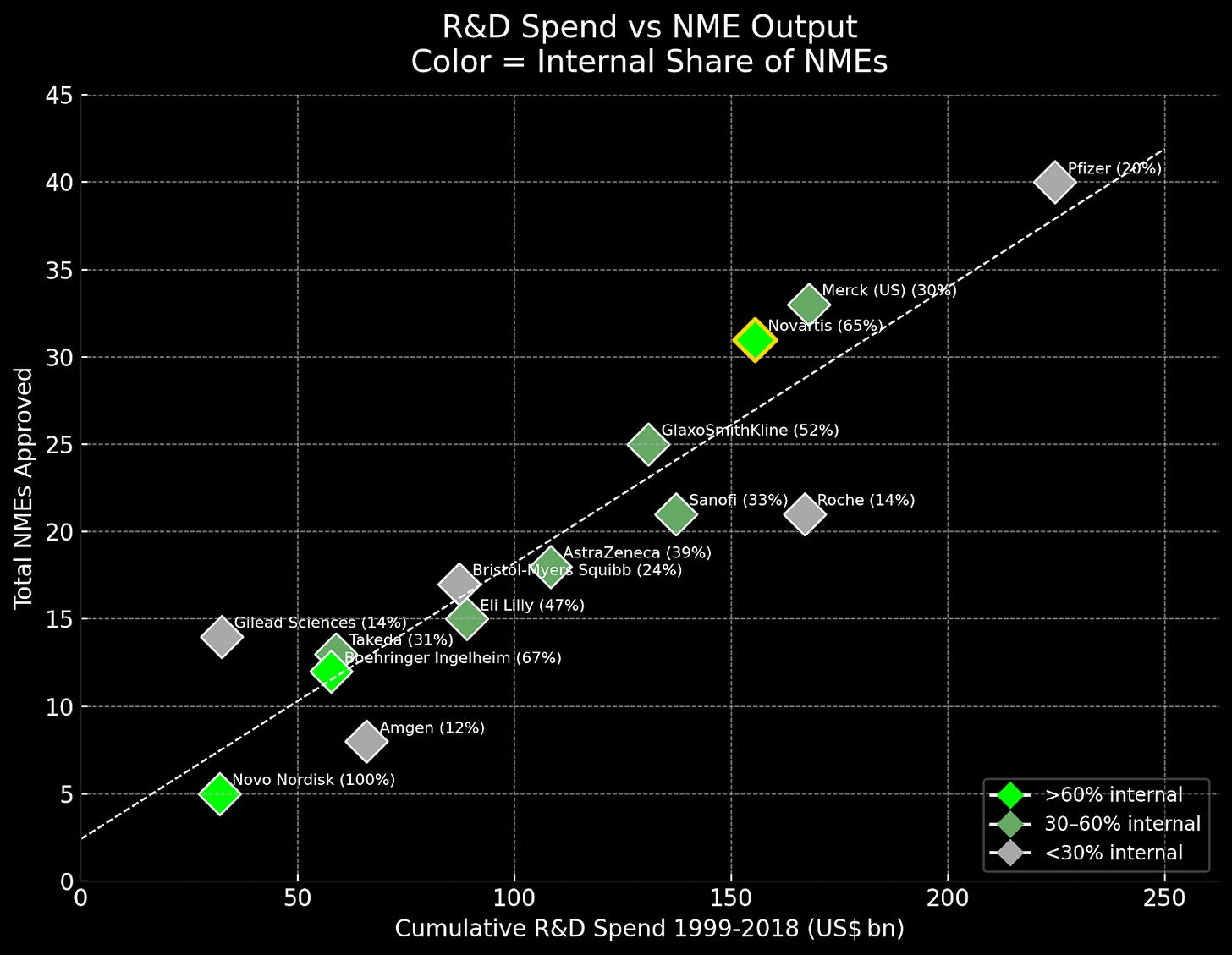

NIBR generated remarkable results: 65% of Novartis’ new drugs came from internal development (versus 20% at Pfizer), with a 16.7% FDA approval rate ranking 4th among major R&D spenders. Four NIBR drugs - Gilenya, Cosentyx, Entresto, and Affinitor - have generated $108 billion in lifetime sales, powering Novartis’ climb from 7th place in 2004 to 2nd place globally by 2014.

While NIBR’s innovations consistently opened entirely new biological territories, competitors that implemented the more conservative “lessons learned” approach saw declining returns. AstraZeneca adopted explicit NPV hurdles and cut its pipeline by over 40 percent. GSK created “kill committees” that terminated over 35 percent of discovery projects based on ROI calculations. These financially driven approaches yielded exactly what economic theory predicts: incremental improvements and risk aversion.

To put this in perspective: the combined income from those four drugs - Gilenya, Cosentyx, Entresto, and Affinitor - were rivaling the entire annual revenues of mature pharmaceutical companies like Moderna ($18B), Regeneron ($12B), or Biogen ($10.9B). Vasella's $250 million bet on a Cambridge candy factory had created what amounted to multiple Fortune 500 pharmaceutical companies worth of revenue from a single research institute.

NIBR had seemingly solved the fundamental paradox of pharmaceutical R&D: how to systematically generate breakthrough innovation within a large organization2. Its four principles appeared to offer a reproducible system for doing what competitors deemed impossible. And for over a decade, its success seemed unshakeable.

But the same market forces that had driven the industry toward externalization were still at work, growing stronger with each quarterly earnings call. Financial pressure from investors was escalating. The end, when it came, would prove that even the most successful innovation models cannot survive indefinitely in a system optimized for short-term returns.

When the Center Could Not Hold

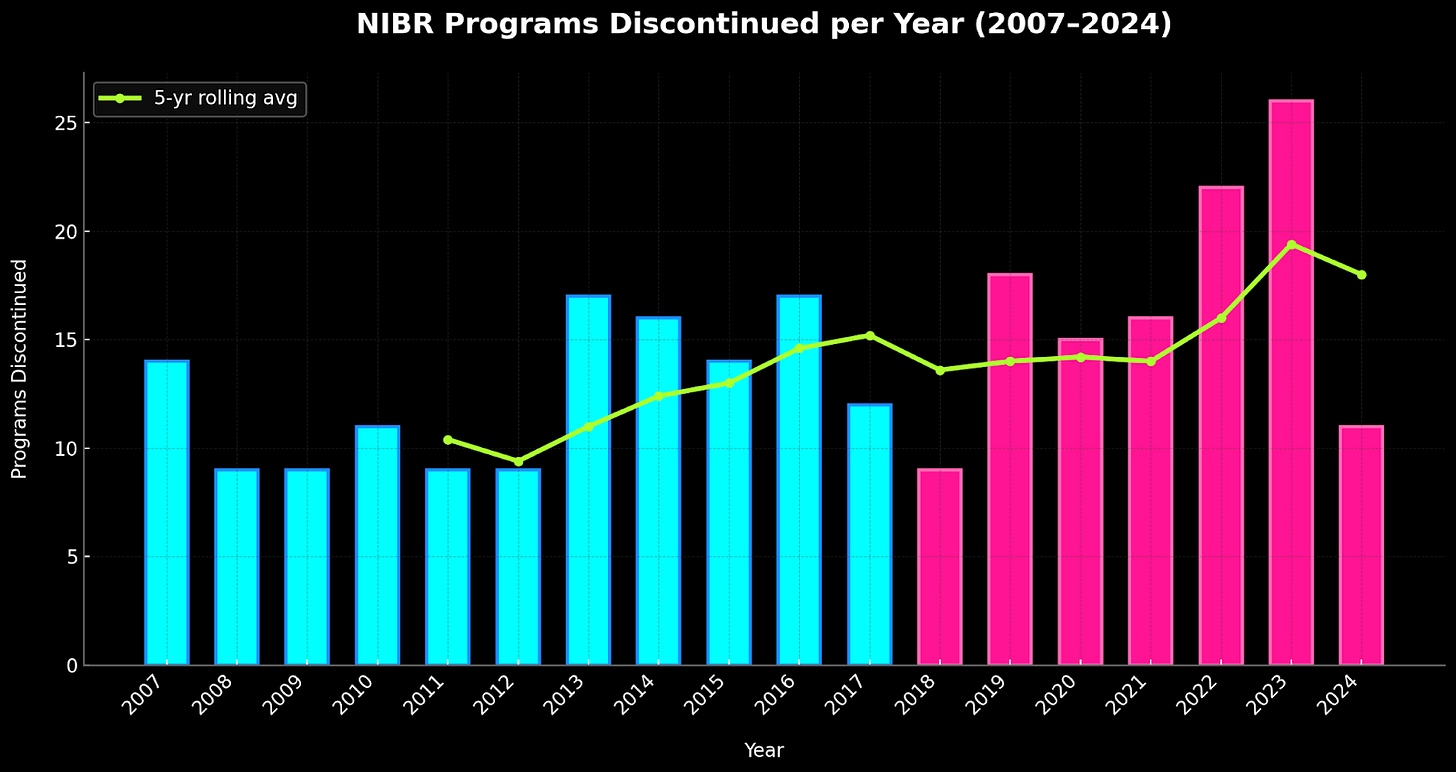

In March 2016, Mark Fishman stepped down as President of NIBR after thirteen years, passing its leadership to Harvard chemical biologist, Jay Bradner. Fishman’s departure left a philosophical vacuum that proved impossible to fill. He hadn’t only been NIBR’s founding father, but also its conscience, championing a biology-first covenant that had sustained the organization through commercial pressures.

Yet the financial reality was becoming impossible to ignore. NIBR’s annual operating costs had ballooned to $4 billion - a sum that could fund entire national science foundations. What had once seemed like visionary investment now looked like profligate spending to shareholders demanding quarterly returns. A McKinsey analysis released earlier this year even suggested that companies pursuing “external innovation” delivered three to eight times higher total shareholder return per invested dollar compared to those maintaining internal research3.

NIBR had expanded globally during its golden years, with specialized facilities in Shanghai, Singapore, and California. But this network began contracting in 2016 as Novartis closed sites and consolidated operations. Press releases spoke of “critical mass” and “operational efficiency” - corporate euphemisms for spreading too thin. Key researcher departures too increased steadily during this period, too. Senior scientists left with their institutional knowledge, many joining Cambridge biotechnology companies (1, 2, 3, 4).

Even NIBR’s most successful drugs faced growing competition. Cosentyx, the leading psoriasis treatment, was challenged by newer competitors offering improved efficacy. Lilly’s ixekizumab and UCB’s bimekizumab were gaining market share as dermatologists found them more effective. Meanwhile, Gilenya - the pioneering oral MS therapy - was being displaced by Bristol Myers Squibb’s Zeposia and J&J’s Ponvory, drugs that eliminated the cardiac monitoring requirements that made Gilenya cumbersome to prescribe. What were once flagship franchises now resembled warships being picked apart by torpedo strikes. Lifecycle management was turning into damage control.

In the Fishman era, programs were evaluated primarily on biological rationale and mechanistic clarity. Under increasing financial pressure, these criteria evolved to include market size, competitive landscape, and peak sales projections. Programs now needed to promise blockbuster revenues to survive.

But here's some cruel irony: chasing blockbuster markets moved NIBR away from the extreme phenotype strategy that made their early successes possible, and devastation ensued. Serelaxin, a heart failure hormone that had shown early promise, collapsed in Phase III, costing Novartis $200 million. Fevipiprant, an asthma drug targeting the CRTh2 receptor, died in 2019 after years of investment. Most devastating was CNP520, an Alzheimer's drug that didn't merely fail - it appeared to accelerate the cognitive decline it was meant to prevent. Even Ilaris, despite CANTOS success, faced FDA rejection for cardiovascular indications due to infection risk and high cost. By 2019, NIBR was shuttering clinical programs at an unprecedented pace, with twenty-one candidates meeting their end in a single year.

When Fiona Marshall, a veteran pharmaceutical executive from Merck, took over from Bradner in late 2022, she inherited an organization resembling a Swiss watch dropped from considerable height. Marshall’s first act was symbolic but telling: "Novartis Institutes of Biomedical Research" plural became "Novartis Biomedical Research" singular - a linguistic neutron bomb vaporizing nearly two decades of autonomy.

At the 2023 STAT Future Summit, she explained that NIBR would focus on “projects likely to yield commercially successful drugs … We want that alignment.” The word “alignment” weighed heavily on whether a program had a clear, near‑term commercial path. In other words, research would get green‑lit only if the development and marketing arms could already see how to turn it into a profitable, approvable drug - which meant the replacement of Fishman’s biology-first covenant with the commercial considerations that would have killed programs like Entresto before they began. In a separate 2023 interview, Marshall stressed that the new NIBR would not any more explore the “cool thing” that a scientist might find, but work on “alignment” with development strategy. Missing from this vision was any semblance of the culture that Fishman had started twenty years before, and with it, confirmation that financial pressures had finally reshaped the entire pharmaceutical sector.

Internal R&D: An Endangered Species

Pharmaceutical companies have discovered something more profitable than discovering drugs: not discovering them at all.

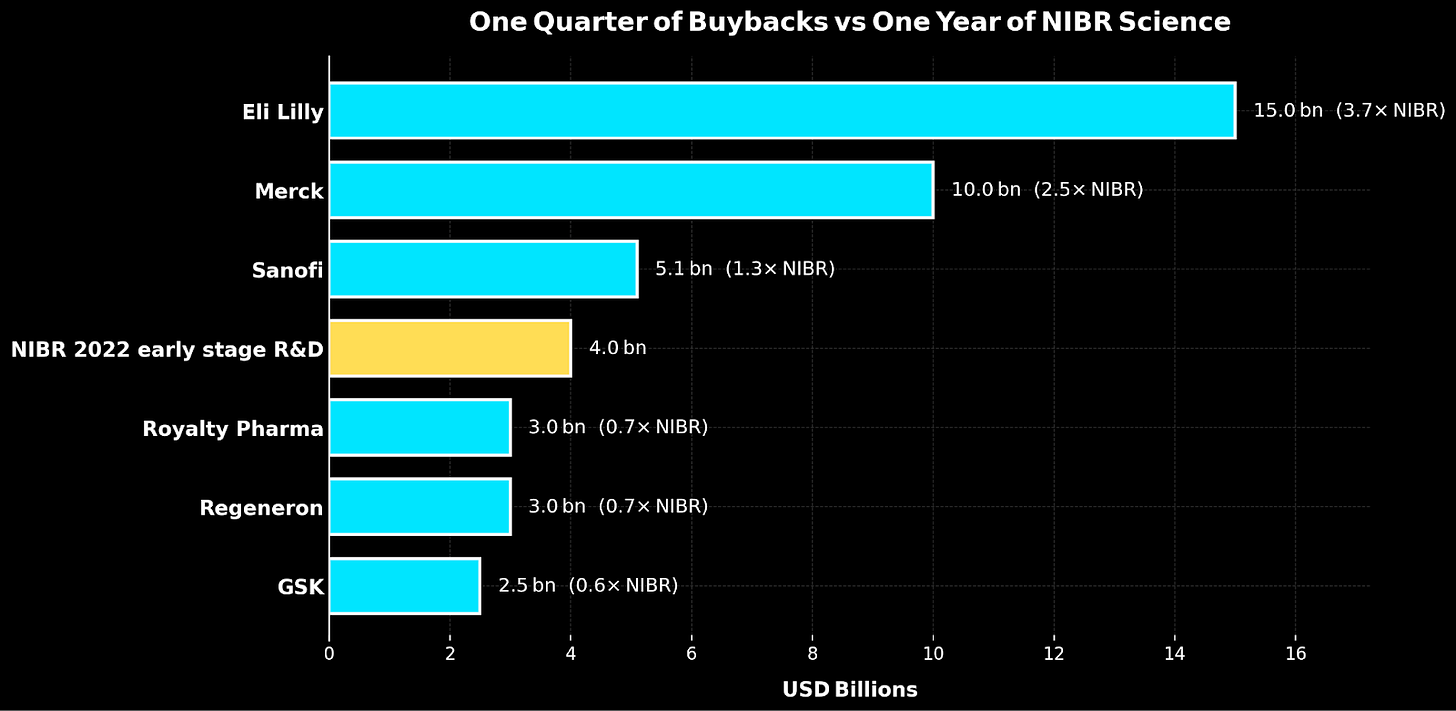

Between 2016 and 2020, fourteen of the world’s largest pharmaceutical companies spent $577 billion on share buybacks and dividends versus $521 billion on R&D - a $56 billion preference for financial engineering over actual engineering. By July 2024, even Novartis’ new CEO Vas Narasimhan would tell investors plainly: “We’d rather use our capital to buy back our own shares … we still have $10 billion in our ongoing buyback program.”

This can be interpreted as pharma companies eating tomorrow’s seed corn. Every dollar diverted from research is a therapy that won’t be discovered, a biological insight that won’t be pursued, and a patient population that won’t be served.

The industry’s response has been to outsource innovation. Since 2018, emerging biopharma companies have led 73 percent of late-stage clinical programs and account for 72 percent of new FDA approvals. Big Pharma has essentially become a licensing and marketing operation, rather than a discovery engine.

But this strategy may be too clever by half. If buying innovation is so much more efficient, why does anyone need internal R&D? Because internal R&D provides something irreplaceable: institutional memory (which targets failed due to toxicity?), scientific judgment (without active researchers, how do business development teams evaluate whether biotech data is genuinely promising?), and long-term perspective (biotechs need to exit within their funding cycles, regardless of optimal development timelines).

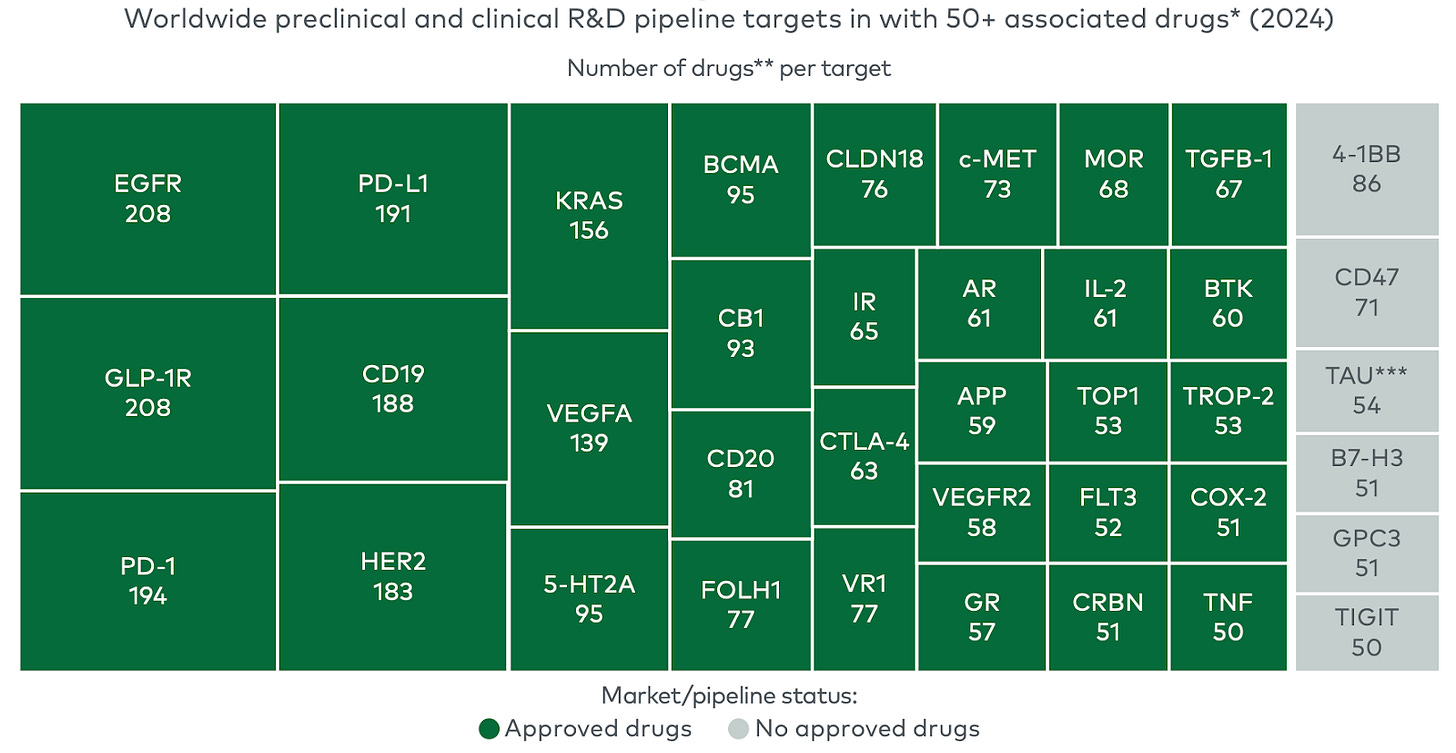

Without institutions like NIBR, the industry increasingly focuses on proven mechanisms rather than breakthrough discovery. Pharma companies lose research capabilities, biotechs optimize for quick acquisition, and true innovation becomes economically risky.

Indeed, what we have seen is that pharmaceutical innovation requires inefficiency. It requires funding ten programs to achieve one success. It requires scientists to pursue hunches that MBA-trained portfolio managers would kill. It requires the kind of patient, curious, often wasteful research that public markets punish but humanity desperately needs.

The glass building endures in Cambridge, now a monument to deliberate amnesia. The scientists who created the impossible have scattered to biotechnology companies, academic institutions, and consulting firms, carrying institutional memory that the industry has chosen to forget.

The lesson of this story ought not to be that NIBR’s model failed; but that even proven innovation approaches can’t survive the relentless pressure of quarterly earnings expectations. Fishman’s four heretical principles generated tens of billions in therapies and remain as valid today as they were twenty years ago. The industry has chosen predictable returns over uncertain breakthroughs; quarterly results over long-term impact.

What dies with institutions like NIBR is the capacity to solve problems we don't yet understand. Every quarter that passes without biology-first research is a generation of therapies that will never exist, patients who will never be treated, insights that will never be pursued.

The twenty-year experiment of NIBR is over. We documented every success, analyzed every breakthrough, and then systematically dismantled what we had learned. The question isn't whether we learned anything from it - we did - but whether we're content to ignore those lessons in favor of the comfortable mediocrity of managing decline.

The choice, as always, is ours. The patients are waiting.

Acknowledgements: A special thanks to Niko McCarthy, Xander Balwit, and Saloni Dattani for reviewing earlier drafts.

The name “Novartis” itself is telling of Vasella’s vision for the company from the very day it was formed: rather than the usual merger playbook of hyphenated compromise, he had chosen "Novartis" - a reversal of the Latin "artis nova," meaning "new art" or "innovation." Either audacious vision or expensive branding exercise - depending on whether the company could live up to its etymology.

Capital allocation calculus and the McKinsey claim.

A 2025 McKinsey study headlined that “external innovation outperformers” generate three to eight times higher productivity than peers, measured as revenues from externally sourced assets divided by the deal’s upfront value.

The analysis flags that additional internal R&D is required after the deal, that partnered assets benefit from selection effects, and that external assets tend to take ~3.6 years longer from Phase I to launch and often cost more due to premiums.

It also excludes the buyer’s post-deal capital (late-stage trials, CMC, launch, label expansions), ignores margin and timing, and benefits from positive selection in what gets partnered. It is useful for ranking deals. It does not answer the company-level question that CFOs care about: risk-adjusted cash returns on total innovation capital across buy and build.

Have seen the cultural shift first hand within NIBR. Great piece.

Cudos to your article about former Novartis research. I have referenced it in a short piece about some deal making activities from Novartis:

https://transkript.de/artikel/2025/novartis-meldet-sich-mit-zwei-sirna-deals-zurueck/

at the end.

Best

georg